This is part of a series of blogs looking at the economics of solar power in Canada today. You can read our blog "What Caused Solar Costs to Fall 99%?" to learn more.

Today we will focus on the impact of accelerated depreciation and how it affects the paybacks and economics for solar generation. While capital costs play an important role in the economics of investing in solar power, the cost of electricity, as well as how much sun your system receives, are also both important factors in calculating the payback and return on investment for your solar generator.

However, one facet of solar’s increasingly improved economics that is often overlooked is the tax treatment of investments in solar. In particular, Accelerated Depreciation can greatly improve your case for solar, especially in the first year.

What is Accelerated Depreciation?

Canada’s Income Tax Act allows organizations to write off depreciation of assets purchased for business purposes (i.e. computers, machinery, equipment). Depreciating the asset creates an expense and reduces taxable income.

In the case of solar generating equipment, it falls under asset class 43.2 within the Income Tax Act which covers renewable and clean energy investments.

Asset class 43.2 is allowed an accelerated Capital Cost Allowance as an exception to the general practice of setting CCA rates based on the useful life of assets. This allows businesses to reduce their taxable income in the early years of an asset’s operation by claiming a larger than usual depreciation, therefore improving cash flow.

The takeaway? If your business is paying taxes, you can save up to 26.5% off (depending on your tax rate) of your system in the first year.

Accelerated Depreciation Makes a Good Situation Even Better

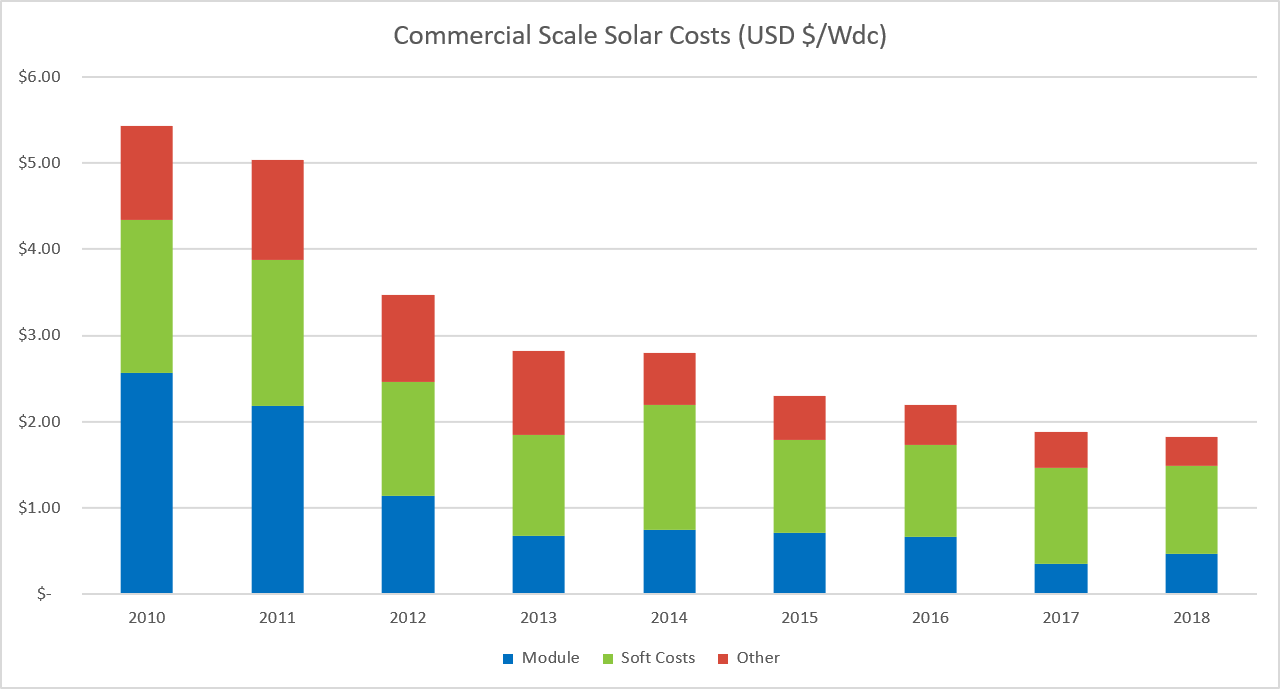

While the case for solar power has been improving steadily since the 80's, nothing compared to the massive leap we saw in the past decade. According to the National Renewable Energy Laboratory, between 2010 and 2018 commercial scale solar costs fell by a whopping 76% (you can read more about how the costs of solar have fallen here).

Figure 1 - Recent Changes in Commercial Scale Solar Costs

It should be noted that, while incentives do exist in certain provinces, that a solar installation today makes economic sense even without utilizing government incentives.

Changes to Canada’s Accelerated Depreciation Rules

So what has changed that has enabled Solar Generator owners to benefit so greatly from Accelerated Depreciation?

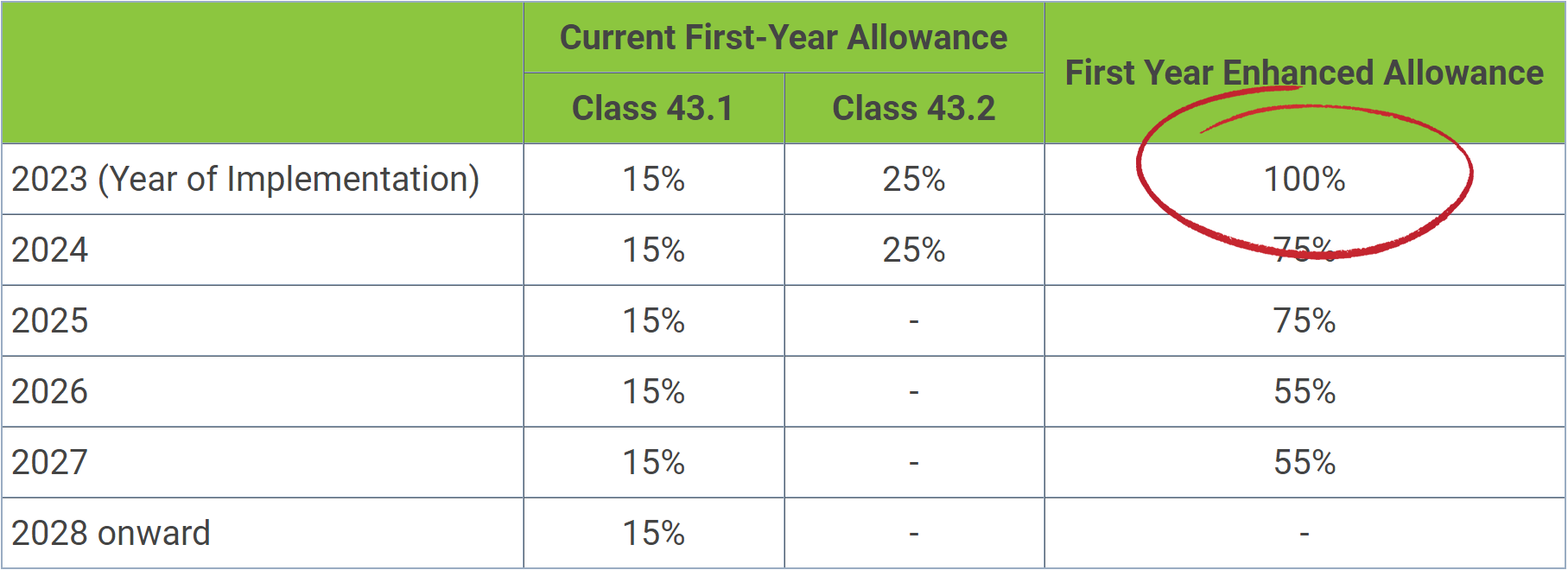

The fall economic statement of 2018 announced an enhanced capital cost allowance (CCA) for asset classes 43.1 and 43.2. Under the current CCA regime, classes 43.1 and 43.2 of Schedule II to the Income Tax Regulations provide accelerated CCA rates of 30 percent (43.1) and 50 percent (43.2), on a declining-balance.

Most systems that are described in Class 43.1 qualify for Class 43.2 when the property is acquired before 2025. In addition, property included in Class 43.1 or 43.2 is eligible from November 20, 2018 and becomes available for use before 2028. The enhanced allowance provides a 100 percent deduction, with a phase out for property that becomes available for use after 2023 as described in the following table:

| Current First-Year Allowance | First Year Enhanced Allowance | ||

| Class 43.1 | Class 43.2 | ||

| 2023 (Year of Implementation) | 15% | 25% | 100% |

| 2024 | 15% | 25% | 75% |

| 2025 | 15% | - | 75% |

| 2026 | 15% | - | 55% |

| 2027 | 15% | - | 55% |

| 2028 onward | 15% | - | - |

Figure 2: Current First-Year Allowance for Accelerated Depreciation (The Half-Year Rule) vs the new Enhanced Allowance Rules

How Do These Changes Help My Solar Investment?

While understanding these changes in depreciation rules won’t make you any more popular, they will improve the economics of your solar investment!

With the enhanced allowance, if you invest $100,000 in a solar system, and are already paying corporate taxes at 26.5%, you can save up to $26,500 in tax payments in your first year.

Which means after year one, your solar system cost is 26.5% lower than what you paid for it.

Accelerated Depreciation Helps you Save Year One of Your Net Metering Project

If you’ve been considering a Solar Net Metering, Accelerated Depreciation should be welcome news!

Net Metering allows you take control of your electricity costs, and hedge against the inevitable rising energy prices, and paybacks can be as low as 5-10 years depending on your project. With a solar Net Metering project, you remain connected to the energy grid, using power just as you would normally.

Once your project is up and running, the energy you produce is subtracted from the energy you consume, reducing your monthly bill. If you produce more power than you consume in a month, the extra power is fed into the grid. You receive a credit to use against future bills. As hydro prices increase, your cost savings per kWh increase.

Your first step is a feasibility analysis, which helps to assess what is needed to build a system and whether or not it makes sense for your business. You can read how we helped a Real Estate company with their Net Metering feasibility analysis here.

Does Solar Make Sense for your Business?

Compass provides expert and nuanced advice to decision makers. We provide detailed feasibility analyses for clients so you have a clear understanding on the economic benefits of going solar as well as any technical and regulatory considerations you should make before making an investment in solar.